There are two techniques for deciding how much cash to maintain at any given point, considering that both holding cash and investing it have both advantages and disadvantages. The purpose of cash models is to satisfy cash requirements at the least cost.

Baumol’s Model

It attempts to determine the optimum cash balance under conditions of certainty. The objective is to minimize the sum of the fixed costs of transactions and the opportunity cost of holding cash balances.

These costs are expressed as:

b x (T/C) + (iC/2)

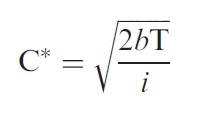

where b=the fixed cost of a transaction, T=the total cash needed for the time period involved, i=the interest rate on marketable securities, and C=cash balance. The optimal level of cash or the optimal cash balance is determined using the following formula:

EXAMPLE: You estimate a cash need for $4,000,000 over a 1-month period where the cash account is expected to be disbursed at a constant rate. The opportunity interest rate is 6 percent per annum or 0.5 percent for a 1-month period. The transaction cost each time you borrow or withdraw is $100.

The optimal cash balance and the number of transactions you should make during the month follow:

The optimal cash balance is $400,000. The average cash balance is:

C/2 = $400,000/2 = $200,000

The number of transactions required are:

$4,000,000/$400,000 = 10 transactions during the month:

The Miller–Orr Model

The Miller–Orr model is a stochastic model for cash management where uncertainty exists for cash payments. In other words, there is irregularity of cash payments. The Miller–Orr model places an upper and lower limit for cash balances.

When the upper limit is reached a transfer of cash to marketable securities or other suitable investments is made. When the lower limit is reached a transfer from securities to cash occurs. A transaction will not occur as long as the cash balance falls within the limits.

The Miller–Orr model takes into account the fixed costs of a securities transaction (b), assumed to be the same for buying as well as selling, the daily interest rate on marketable securities (i), and the variance of daily net cash flows. A major assumption is the randomness of cash flows.

The two control limits in the Miller–Orr model may be specified as ‘‘h’’ dollars as an upper limit and zero dollars at the lower limit. When the cash balance reaches the upper level, h less z dollars of securities are bought and the new balance equals zero, and z dollars of securities are sold and the new balance again reaches z.

The optimal cash balance z is computed as follows:

The optimal value for h is computed as 3z. The average cash balance will approximate (z+h)/3

Based on example above, what is the total cost of maintaining cash balances?

ReplyDeleteTotal cost is $1100

DeleteThe total cost is $1100

ReplyDeleteDetermining the optimal cash balance is a dynamic process that requires ongoing analysis and adjustment based on changing business conditions. Businesses must strike a balance between maintaining sufficient liquidity and maximizing the use of funds for investment or debt reduction.

ReplyDeleteMoolamore is an advanced accounting application that analyzes, manages, and projects real-time transaction data. Using our cash flow forecasting software and app, you can forecast and estimate your company's future financial position. Best Cash Flow Forecasting Software